Life Insurance in and around Lynden

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It can be a big deal to provide for your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that those closest to you can keep paying for your home and/or maintain a current standard of living as they face the grief and pain of your loss.

Insurance that helps life's moments move on

Life happens. Don't wait.

Agent Amy Warenski, At Your Service

You’ll get that and more with State Farm life insurance. State Farm has terrific protection plans to keep your family members safe with a policy that’s modified to match your specific needs. Thank goodness that you won’t have to figure that out on your own. With empathy and fantastic customer service, State Farm Agent Amy Warenski walks you through every step to set you up with a plan that shields your loved ones and everything you’ve planned for them.

Interested in finding out what State Farm can do for you? Reach out to agent Amy Warenski today to get to know your personalized Life insurance options.

Have More Questions About Life Insurance?

Call Amy at (360) 354-6868 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

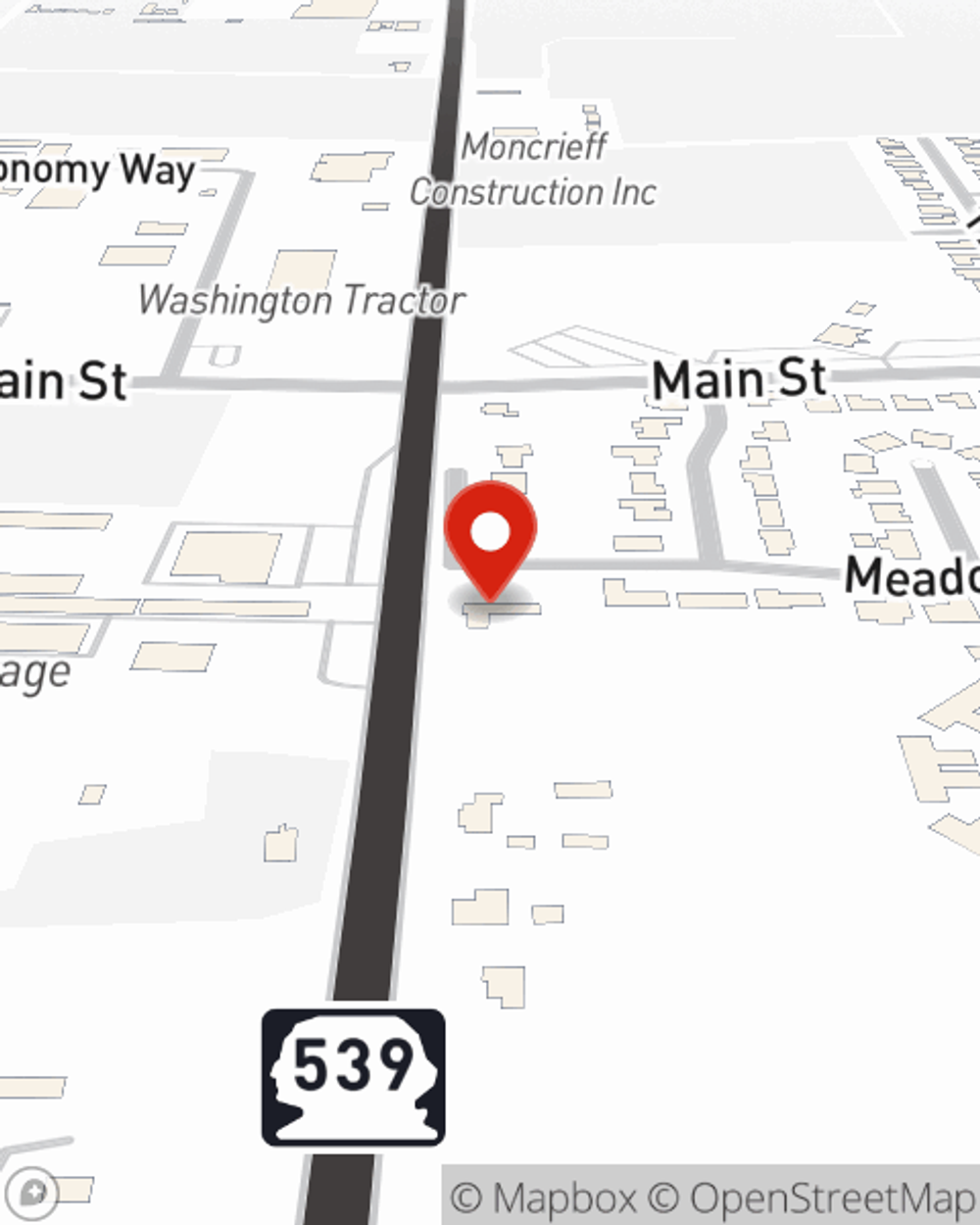

Amy Warenski

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.